Rapidly changing weather patterns are already moulding the way we operate our businesses and demand governments as well as the private sector to invest in research and development for adaptation of greener technology. Estimates vary on the cost of slowing down global warming, given the wide range of sectors that must be surveyed – Morgan Stanley found that by 2050 the world will need to spend USD 50 trillion to achieve net-zero emissions. Closer home, India needs to spend an estimated USD 170 billion annually if we want to meet our Nationally Determined Contributions (NDCs) under the Paris Agreement. The nation’s current spending on climate change (USD 19 billion) sits at around one-tenth of what is needed.

For private enterprises, transforming manufacturing and operations to become environmentally friendly is an expensive process – from calculating emissions to building strategies, and to ultimately executing said strategies – each activity requires budgeting and financing. Governments across the globe are cognizant of the growing financing need, both at a state and industry level, to bridge the massive gap in funding climate action. This is where the concept of green financing emerges.

What is Green Financing?

Green Financing refers to financial products and services that support environmentally sustainable projects and initiatives. These projects span a wide range of sectors – alternative energy, conservation of biodiversity, water, sanitation and hygiene, and waste management. Green financing aims to provide financial resources to businesses, governments and individuals to promote sustainability and reduce their negative environmental impact. Financial innovations can play a crucial role in enabling the transfer to a low-carbon and resource efficient economy by allowing investments in projects that aim to increase resource efficiency, reduce GHG emissions and support the development of alternative energy sources- nuclear, solar and hydro. Green Finance also offers the potential to create new jobs; according to the International Labour Organisation (ILO), going green could create 24 million new jobs globally by 2030.

What are the instruments of green financing?

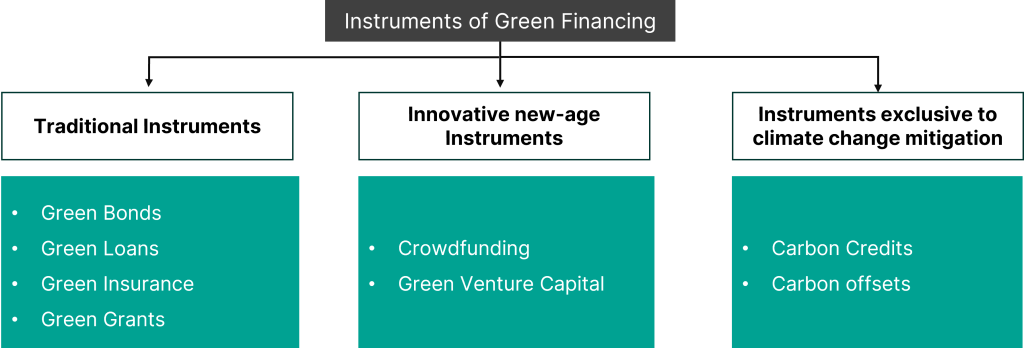

Green Finance instruments can be developed by tweaking existing financial instruments to service environmental preservation. Popular instruments try to attract investments by offering a positive (fiscal) return on investment; a valuable promise that justifies investment from a business point of view. Some of the popular climate finance tools have been discussed in the following table.

1. Green Bonds: A green bond refers to debt security issued by an organisation or the government to raise funds from investors exclusively for projects that have positive environmental or climate benefits. They help mobilise capital from a range of investors, including institutional investors, retail investors and impact investors. Green bonds can back the transition to a low carbon economy by providing funding for renewable energy projects, energy efficiency improvements and other climate-friendly investments.

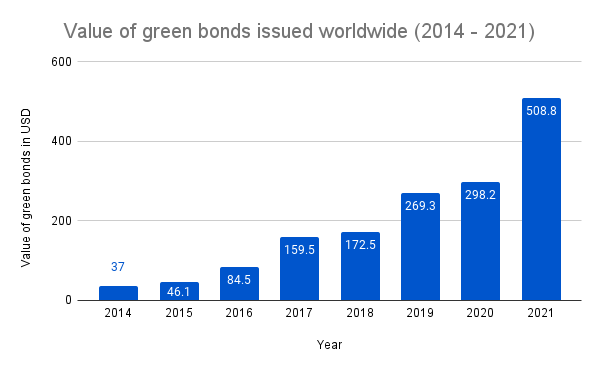

It was introduced by the European Investment Bank in 2007. In 2008 the World Bank started issuing green bonds to fight climate change, since then the market for green bonds has constantly expanded. At present upwards of fifty countries issue green bonds and according to the Climate Bonds Initiative global green bond issuance in 2021 was estimated to be USD 522.7 billion.

In 2015, SEBI introduced guidelines to issue green bonds in India, since then many Indian companies have issued green bonds. JSW, Hydro, GreenKo and Adani Green are some of the biggest issuers of green bonds in India. The domestic green bond market in India is very small – pegged at at USD 20 billion and accounts for only 3.8 percent of the country’s overall corporate bond market.

It is important to note that Indian green bond proceeds are disproportionately concentrated in the energy sector, there is a need for green bonds to diversify its operation bases in India. Issuing authorities often complement interest payments on green bonds with tax incentives (tax exemption or tax credits) to attract investment. Despite clear opportunities for investors the lack of a concise definition on the demarcation between a conventional bond and a green bond can dissuade investors. There is a need to develop a clear definition of green bonds and institute transparency mechanisms to allow investors clarity on how their investments are being used and quantify the environmental impact of the investment. A safe bet can be to invest in green bonds issued by the sovereign government. The Government of India joined the Sovereign Green Bonds Club in January 2023; there is an increased demand for these state issued green bonds allowing the RBI to obtain a greenium i.e, cheap green financing.

2. Green Loans: A green loan helps individuals, businesses and governments secure the necessary funding to finance environmentally sustainable projects and enterprises. Green loans can be a lucrative source of finance for both businesses and households. The interest rates on green loans are often more generous than on traditional loans.

Green loans can incentivise households to install solar panels, purchase electric vehicles and build rainwater tanks; green loans offer consumers an opportunity to improve the quality of their lives and reduce expenses (by migrating to environmentally sustainable practices) in the long run at low interest rates. Businesses are often constrained by a misconception that transitioning to green, low carbon pathways always comes as an added cost, and at the expense of profits. A green loan can help companies (including MSMEs) embed sustainability at the core of the business and not as an annual ESG requirement. Businesses with green loans can signal to their customers and investors alike that they care about the environmental impact of their businesses and win a competitive advantage in the market and attract investments from socially responsible investors.

Despite the clear promises made there is currently no documentation or market standard linked with the Green Loan Principles on what constitutes a green loan, leaving it to the borrower and financier to arrive at a mutually agreeable definition. In the absence of a sustainability taxonomy, it becomes easier for businesses to greenwash their practices, which in the long run undermines the value of truly sustainable projects.

In India, according to RBI guidelines, the Renewable Energy sector falls under Priority Sector Lending; the RBI uses the PSL category to nudge commercial banks to support the development of identified sectors. India banks are keen to extend more green loans to consumers and businesses and have requested the RBI to include loans for EVs and green hydrogen to be included under the PSL category.

3. Green Venture Capital (VC): Green VC can finance projects and companies that are developing sustainable technologies to ensure environmental conservation and battle climate change. It can provide sectors such as energy, waste and mobility much needed access to finance to develop cleaner technologies. Technology based green startups can often find it difficult to secure funding from traditional sources given the high risk on investment, VC funding can help offset these risks.

While climate technology markets as of 2022 constitute upwards of 25%of all VC led investment, there exists a mismatch in capital need and availability among the sectors. Mobility and transport sector which accounts for 16% (2016) of global emissions has a disproportionate share of 61% of climate tech investments (2021). Sectors such as built environment, sustainable agriculture and manufacturing are underfunded and require access to green finance to decarbonise their processes. Channelling funding to these underserved sectors could help earn a first mover’s advantage and a potential green patent, which would reap heavy dividends in the future – both for the climate goals and for the enterprises in the sectors.

Government intervention is crucial for securing the trust of investors; traditional policy schemes subsidising non-renewable energy and the lack of tax incentives for green startups can signal low commitment towards managing climate change and discourages VC backed investments. In India, there is no clear regulatory framework for green investments, which creates uncertainty for large institutional investors. To drive green VC in India the government needs to do two things – first, set standards on what constitutes a green sector and second, ensure there is continuous capital flow into these sectors to keep the projects financially sustained. India is behind other countries like the US and China where the finance ministries have rolled out generous tax exemptions and tax credits to push entrepreneurship in green industries.

4. Green Grants: Green grants are aimed at empowering communities and businesses to implement projects that allow them to mitigate (or adapt to) climate change, manage their local natural resources and innovate ways to preserve the natural environment. Green grants are offered by governments, philanthropic organisations, private foundations and green NGOs that promote sustainable development. Green grants can also be extended to research facilities and universities to fund research work on climate change and sustainable development. They can help close the funding gap for financially unprofitable projects i.e. projects on which there is no financial return on investment.

Global Greengrants Funds, one of the leading organisations, believes in a bottom-up approach; they provide green grants to grassroot led efforts in an attempt to empower local communities to harness traditional knowledge and locally innovated strategies to deal with climate change. The Green Climate Fund instituted under the UNFCCC in 2010, has committed USD 12 billion to climate change management, with a special focus on sanctioning grants to least developed countries, small island developing states, and African states.

5. Green Insurance: Green insurance attempts to incentivise sustainable consumption and production by offering lower premiums to green businesses and purchases. Globally financial institutions are increasingly giving priority to sustainability linked insurances post the release of the Principles for Sustainable Insurance manual by the UNEPFI which delineates how insurance companies must contribute to the sustainable development agenda by helping green project insurers quantify risks and thereby mitigate climate risks better.

One of the challenges while issuing green loans is the lack of a cohesive definition on what constitutes a green product, this makes it difficult for banks to offer green insurance. For instance, while it is universally acknowledged that EVs are less polluting than traditional fossil fuel run automobiles, they do have a negative impact on the environment. The lithium-based EV batteries are difficult to dispose of and as the numbers of EVs on the road increases, it will get increasingly difficult to manage a large volume of e-waste. Thus, even with green products-there are shades of green, which makes the task of identifying green products a complex one. While rolling out insurance policies banks need to beware of fraudulent green claims by organisations and should provide the green premium post inspection.

At the same time, such insurance is vital for encouraging green products in India due to its vulnerability to weather risks and has poor adaptive capacity for climate change. Agriculture, a source of livelihood for half the country, is vulnerable to climate change, floods and droughts. Green insurers encourage sustainable agriculture among small farmers by providing generous crop insurance premiums for sustainable agriculture. The RBI saw value in Green Insurance in 2016, when it advocated that Green Insurance will encourage companies to internalise the costs of environmental damage, and thereby better manage their negative environmental externalities.

6. Carbon Markets: At the Glasgow COP26 Climate Change Summit in 2021, participating nations agreed to set up a global trading market for carbon credits. One carbon credit allows a company to emit up to one tonne of carbon dioxide in the atmosphere. Polluting companies are awarded credits that allow them to pollute up to a certain level (cap), and the credits offered are reduced every year, nudging businesses to turn climate friendly.

In the presence of a carbon market, firms are be incentivised to sell their unused carbon credits and earn revenue, which can be reinvested in R&D to grow sustainable technologies. Currently there are two types of carbon markets– compliance markets (carbon credits) and voluntary markets (carbon offsets). The former is created by a sovereign and is a regulatory requirement, while the latter refers to issuance and buying of carbon credits on a voluntary basis.

The terms Carbon Offsets and Carbon Credits are often used interchangeably despite the two instruments serving different purposes. For every tonne of CO2 that an activity manages to absorb, avoid or otherwise reduce, a carbon credit can be issued. A carbon credit is a tradeable permit that allows a polluting company to emit one tonne of CO2 and can sold or purchased depending on the volume of CO2 the company emits. A carbon credit may be created by the government or awarded when the equivalent of one tonne of carbon dioxide (CO2 -e) is removed from the atmosphere and stored in the land or is prevented from being released into the atmosphere. Both, carbon offsets and carbon credits are instruments sold in the carbon market.

Carbon credits provide an opportunity to developing countries to advance socio-economic development while transitioning to a low carbon economy. Awarding carbon credits/offsets is a smart way to nudge companies to transition to cleaner energy systems. Once a majority of companies have made the transition, supply of carbon credits/offsets will exceed demand, rendering the credits less valuable, but the tool will have served its purpose.

7. Crowdfunding: Crowdfunding is a process wherein a business/individual obtains funding from a large pool of interested backers, each of whom provides a small amount of money directly, without the aid of any standard financial intermediary. The contribution can be purely philanthropic, or the funder might be expecting a social/environmental return. In the absence of access to traditional financing mechanisms crowdfunding can allow green businesses to kickstart their operations.

For Crowdfunding platforms (CFP) to be successful they must be able to clearly communicate their climate goals and plan for the funds to potential funders; this would especially be the case for donation-based funds. For equity-based crowdfunding and lending-based crowdfunding, green enterprises would need to be able to materially demonstrate expected financial and environmental returns based on their activities to assuage the fear of risk in the minds of investors. Relying on CFPs can, however, be risky; CFPs have different levels of management ability and operational standards, and with multiple CFPs in place it is difficult for the investor to figure out which is a viable agency. Crowdfunding also lacks the promise of a steady source of capital and is extremely vulnerable to an economic shock.

In India, despite crowdfunding emerging as a popular way of mobilising capital, state support for the instrument has been rather bleak. The Central Government has expressed no intent to introduce legislation on crowdfunding, instead, it warned citizens that crowdfunding activities are not regulated under the Companies Act 2013. Introducing a manual on crowdfunding could potentially help augment donor trust in the fiscal instrument and allow more grassroot campaigns and enterprises to raise funds for their projects.

The road ahead

Public finance has been leading the way for climate management projects. If India hopes to deliver on its NDCs and attain the targets under SDG 13 in time, a ramp up operations would be needed. Regulatory and legislative support to green financing can play a key role in securing private sector help for sustainable development. Some measures to set the ball rolling have been discussed below.

Develop a green taxonomy: A green taxonomy is a classification system that identifies investments in products and services as sustainable (and by extension unsustainable). It provides a common language and framework for investors, companies and policymakers to evaluate the environmental impact of investments and economic activities. A green taxonomy will help investors tide over the informational asymmetry in the sustainability market and allow them to invest in environment positive projects. It can help small companies chart their green transition and build knowledge on the environmental impact of existing policies and the alternatives available to them. A green taxonomy can also help deal with the challenge of greenwashing. It will provide a transparent and standardised way for companies to disclose their environmental impact, allowing shareholders and stakeholders to hold them accountable for their sustainability performance.

Policies to strengthen investor confidence: The national government must communicate its commitment to climate goals to secure investor confidence; investors want to be sure that their investments have long term value and policy support. Ambitious climate targets send a clear message to investors that the nation is committed to sustainable development (in the long run). Financial incentives such as- tax breaks, grants and subsidies to climate positive investments and purchases can help build investor trust.

Join the Global Bond Index (GBI): As discussed above the Indian green bond market constitutes a meagre 3.8 percent of the domestic bonds market; joining the international bond market will open up more funding opportunities for green bonds. The Indian government has refused to join the global bonds index. Inclusion into the GBI, according to Morgan Satnley could see investors pump in USD 30 billion, within the first ten months. The Finance Ministry said it is unwilling to discriminate between domestic and foreign investors with regard to subjecting them to the capital gains tax. A compromise will need to be reached, if India hopes to attract international finance in the green bond market. One policy decision could be to offer tax breaks to domestic investors as well, in an order to ensure greater local settlement of government securities.

Integrate with the international carbon market: An international carbon market can help reduce GHG emissions in a cost effective manner. It will help harmonise carbon prices across jurisdictions and level the international playing field. For integration to be possible there needs to be multilateral cooperation on setting standards on accounting for emissions. Participating states will have to establish a threshold on emissions (cap) in tune with their NDCs and monitor all emissions in the economy.

Sustainable development is no longer a moral imperative, it is a practical necessity to ensure the wellbeing of human life on the planet. It is imperative that governments and business collaborate to prioritise green public financing as a key strategy to achieve a sustainable and prosperous future for all.