In order to mitigate the climate crisis, countries across the globe have made ambitious commitments with the intent to reduce greenhouse gas (GHG) emissions.

For these goals to be actualised, governments and private entities need to adopt structured climate-positive actions – measure, reduce, and offset. Put simply, in order to manage an entity’s carbon footprint, it is essential that we first measure and then come up with strategies to reduce emissions. In recent years, we have witnessed countries and businesses making progressive decisions towards carbon neutrality. Yet the journey towards net-zero appears tedious – a recent UNEP report suggests that to the 1.5-degree target, we must remain within a 570 gigaton (Gt)CO2 cumulative 2018–50 carbon budget. This goal requires net GHG emissions to fall by 23 Gt by 2030. However, as industries grow and economies advance, reducing emissions becomes arduous. In emission-intensive sectors such as steel, aviation, and oil & gas, it is particularly harder for businesses to abate emissions without significantly altering operations and business models. Over the years, this has led to the emergence of what we today know as carbon offsets.

What are Carbon Offsets?

Carbon offsets are tradable “rights” or certificates linked to activities that lower the amount of carbon dioxide in the atmosphere. A carbon offset represents a removal of GHG emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. So, any activity that absorbs a tonne of CO2 from the atmosphere in one part of the world would cancel the effect of a tonne of gas emitted in another. When an entity is unable to avoid, reduce, or remove emissions from its own value chain, it funds activities elsewhere to remove emissions from the atmosphere in their stead.

Carbon Offsets vs Carbon Credits – is there a difference?

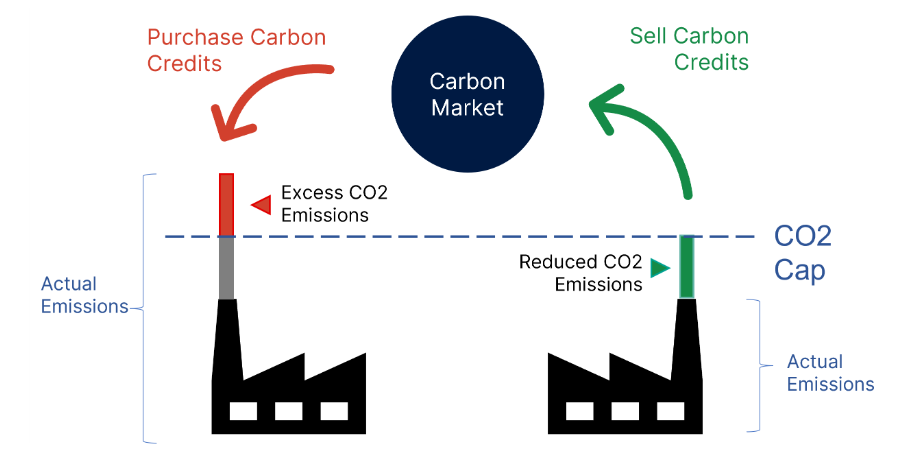

The terms Carbon Offsets and Carbon Credits are often used interchangeably despite the two instruments serving different purposes. For every tonne of CO2 that an activity manages to absorb, avoid or otherwise reduce, a carbon credit can be issued. A carbon credit is a tradeable permit that allows a polluting company to emit one tonne of CO2 and can sold or purchased depending on the volume of CO2 the company emits. A carbon credit may be created by the government or awarded when the equivalent of one tonne of carbon dioxide (CO2 -e) is removed from the atmosphere and stored in the land or is prevented from being released into the atmosphere. Both, carbon offsets and carbon credits are instruments sold in the carbon market. Further, there are two kinds of carbon markets, compliance markets and voluntary markets.

Compliance markets, as the name suggests are set up by the governing bodies of a specific jurisdiction and are called by different names, including regulated markets, Emissions Trading System (ETS) or Cap and Trade. Some examples of the compliance markets are the European Union ETS, the Korean ETS, and the California Cap and Trade. In the compliance market, credits are “generated” by the government. Carbon credits represent the right to release emissions and not emission reduction. Carbon Credits or Allowances are traded in this market. The compliance market implies that the demand for emission reduction is driven by regulation. Approval and verification of emission reduction credits in the compliance market are driven by an extensive regulatory architecture that approves projects based on certain pre-determined conditions.

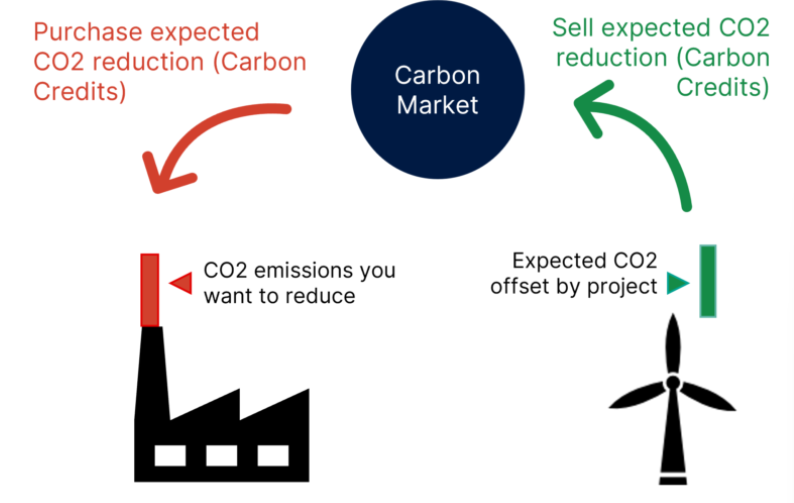

Voluntary markets, on the other hand, are based on self-action and are not as strongly regulated. In voluntary markets, trade is not limited to carbon credits – participants can create and trade carbon offsets as well. Demand in the voluntary market is driven by company-level voluntary obligations to demonstrate low-carbon and sustainability-related actions to shareholders and stakeholders. Approval and verification of credits in the voluntary market is done by private companies called registries that have built a brand for themselves for this critical task in the value chain.

How do Carbon Offsets work?

In the past two decades, markets for the exchange of carbon offsets have evolved and developed processes that facilitate orderly exchange. The voluntary carbon offset market is regulated by non-governmental actors and a handful of registries. The process of generating a carbon offset begins with the production of an ERR or Emission Reduction or Removal. Once an ERR has been generated and certified under a reputable standard, it can be issued as a tradable unit called a “carbon credit”.

When a carbon credit is used to compensate for emissions elsewhere, it is “retired”, i.e., taken out of circulation and can no longer be sold; at this point, a carbon credit becomes a carbon offset. ERR and subsequent generation of a carbon offset can be done in a number of ways – preventing deforestation, preserving forests, planting trees, distributing fuel-efficient cookstoves, changing agricultural practices, and capturing and destroying landfill gas are a few of the many examples. To ensure the credibility of the offset and whether emission reductions or removal are real, carbon offsetting projects need to be validated and verified by an internationally verified standard.

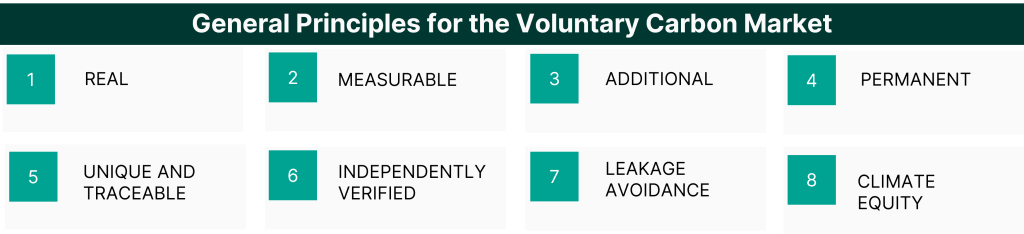

Offsetting projects must satisfy the robust criteria set by standardisation bodies. The following image briefly describes the criteria for a project to be certified and generate carbon credits:

Additionally, appropriate safeguards must be put in place to ensure projects comprehensively address and mitigate all potential environmental and social risks.

Emission reduction projects operate in 8 major sectors wherein projects earn certified emission reduction (CER) credits, each equivalent to one metric ton of CO2. These sectors are – Forestry and Land Use, Renewable Energy, Chemical Process/Industrial Manufacturing, Household/Community Devices, Waste Disposal, Energy Efficiency/ Fuel Switching, Agriculture, and Transportation.

What is the scope for voluntary carbon markets?

Reports suggest that achieving the 2030 goal of reducing emissions by 23 Gt requisites achieving 2 Gt of emissions sequestration and removal, which requires a 15-fold scale-up of voluntary offsetting in 2030 versus 2019, assuming carbon credits are used to finance all of these actions. 2022 saw This is possible only if corporates significantly step-up commitments, which are sized at just 0.2 Gt in 2030, based on 2020 numbers.

The market for carbon offsets is highly dependent on worldwide regulatory efforts to hold countries accountable for their climate impacts. As of February 2023, more than 2500 companies across the globe had committed to achieving net-zero CO2 emissions by 2050. Tighter compliance mechanisms, stakeholder activism, and mainstreaming of climate conversations will only lead to an increase in this number, which is likely to expand the market exponentially. According to a 2022 report on the market outlet by Bloomberg, “The price of offsets could rise significantly, creating a $190 billion market as early as 2030,”. In 2021, global emissions exceeded 36.3 gigatonnes.

It is estimated that while Europe and China will be able to reduce local emissions marginally, the net global emissions will see a rise. Reduction and removal of emissions are critical to ensure a healthy planet for future generations. Carbon offsets carry immense potential to help advance the journey towards net neutral in the coming years. In this regard, voluntary carbon markets have held their place as a critical lever to realise climate goals. With carbon emissions rising, the growth of the markets has been driven by increasing corporate efforts to offset their carbon footprints. As stakeholders and consumers begin to hold corporates accountable to take climate action, more companies are setting net-zero targets, leading to increasing demand for climate solutions – one of which is provided by the voluntary carbon market.