The Securities and Exchange Board of India (SEBI) has approved the launch of electricity derivatives on the Multi Commodity Exchange (MCX) or NSE, a new instrument for managing risk in the rapidly evolving power sector. This move brings the Indian electricity market closer to being in line with global energy trading practices – offering generators, distribution companies, and large consumers a transparent way to hedge against price volatility.

What are electricity derivatives?

Electricity derivatives are financial instruments that derive their value from the price of electricity in the spot or wholesale market. These include futures and options contracts, which allow participants to lock in electricity prices for a future date.

The most common forms are:

- Futures contracts: Agreements to buy or sell electricity at a predetermined price and at a future date.

- Options contracts: Financial instruments that give the buyer the right (but not the obligation) to buy (call) or sell (put) electricity at a set strike price before a specified date.

Unlike physical power purchase agreements (PPAs), which involve the delivery of electricity, derivatives are settled financially. Meaning, the buyer or seller does not take actual delivery of electricity but settles the difference between the contract price and the market price.

This form of financial hedging allows commercial and industrial (C&I) players, distribution companies (DISCOMs), and power producers to better manage cost exposure and plan electricity procurement with greater confidence.

What are the use-cases?

Let’s take two examples to understand how electricity derivatives would work:

1. A DISCOM hedging its procurement price

A DISCOM secures a long-term power-purchase agreement at ₹5.8 per kWh starting in January. Expecting wholesale prices to soften, it hedges by selling January electricity futures on MCX at ₹5.8.

When January arrives, the day-ahead market settles at ₹4.2 per kWh. The short futures position pays the DISCOM ₹1.6 per kWh, cancelling out the premium embedded in the PPA. Net effect: the utility’s effective cost drops to roughly ₹4.2 per kWh, in line with the market instead of overpaying.

2. A manufacturing business hedging against peak prices

A large commercial buyer expects a summer price surge due to increased air-conditioning loads. To protect against this, it buys a call option at ₹6.5/unit for June. If prices spike to ₹8/unit, the business gains ₹1.5/unit on the option. If prices remain stable, the only cost is the option premium—similar to paying an insurance premium against price shocks.

In both cases, the physical electricity continues to be delivered via traditional channels, but the price risk is financially managed.

Benefits to the sector

- Price stability for end-users, enabling better forecasting and budgeting

- De-risking of RE procurement, especially for corporate buyers with variable loads

- Flexibility for DISCOMs to respond to demand and supply fluctuations

- Market depth as financial traders enter the power sector and improve liquidity

- Efficient price discovery that reflects both physical supply-demand and forward expectations

Globally, mature electricity markets in the US, Europe, and Australia already use derivatives to manage risks and encourage competition. India’s entry into this space indicates a growing maturity in market design and an intent to move towards a more competitive, transparent power ecosystem.

Why do they matter?

Electricity prices in India are becoming more volatile due to several factors:

- Increased penetration of renewable energy, which is inherently intermittent

- Rising use of short-term power markets and power exchanges. Volumes traded in the short-term market rose 12 % year-on-year.

- Greater demand-side participation by industrial and commercial consumers

- Climate-related supply shocks (like unseasonal rain or heatwaves)

Over 90% of India’s electricity is currently transacted through long-term PPAs, many of which last 25 years. These agreements do not reflect real-time market dynamics and often lack flexibility. As the grid integrates more renewable energy, price volatility is likely to increase due to variable generation and weather-driven supply shocks.

Electricity derivatives are basically “price-lock” deals for power: you agree today on the rate you’ll effectively pay later, so surprise spikes (or dips) don’t negatively impact your budget.

How will the market function?

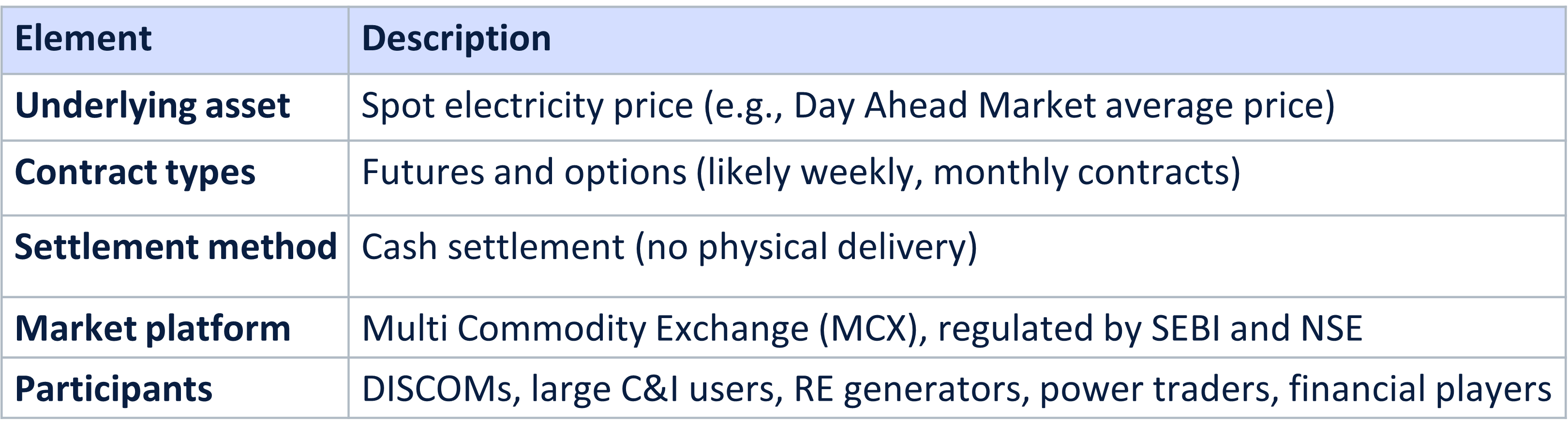

SEBI’s green light lets both MCX and NSE list cash-settled electricity futures (and, shortly, options). Each contract is financially closed out against the average Market-Clearing Price in the Indian Energy Exchange (IEX) Day-Ahead Market (DAM) on the delivery day – no physical power changes hands. The IEX-DAM index is the sole benchmark for this first wave of products. Prices from other power bourses such as PXIL or HPX are not part of the settlement formula.

Key elements of how the market will work:

Participants in the market:

- Hedgers: DISCOMs or businesses that want to fix electricity costs in advance and avoid price shocks.

- Speculators: Traders who take positions based on expected price movements, adding liquidity to the market.

- Arbitrageurs: Entities that exploit price differences between physical and derivatives markets, improving price alignment.

This structure mirrors how crude oil, natural gas, and other commodities are traded globally. Derivatives provide liquidity, enable price discovery, and improve transparency across the value chain.

What remains to be addressed?

- Liquidity in early phases: Success will depend on participation from both physical and financial players

- Integration with spot markets: Benchmarking contracts to reliable, transparent price indices will be key

- Education and risk management: Buyers and sellers will need training to avoid misuse or overexposure

- Regulatory clarity: Coordination between SEBI, CERC, and exchanges must be watertight, especially for overlaps in financial and physical markets

For businesses already using open access or VPPAs, electricity derivatives can act as a layer of risk management – hedging exposure when demand peaks or when market prices become volatile. For companies new to market-based procurement, derivatives offer an entry point into more active energy cost control. This is not just a new financial product. It’s a signal that India’s power sector is opening up to more sophisticated, market-driven mechanisms. And for businesses ready to lead the way, this could become a decisive competitive edge.

As electricity derivatives become part of India’s energy landscape, Neufin folds them into the broader suite of solutions we offer our clients. Our approach combines deep knowledge of procurement modes, tariff structures, and demand forecasting with financial intelligence to help businesses build customised energy strategies. With electricity derivatives now a real possibility, Neufin can help buyers integrate them into procurement planning, financial reporting, and ESG-aligned decision making.