Voluntary carbon credits are units that can be traded and represent the reduction, avoidance, or removal of one metric ton of carbon dioxide or its equivalent(1tCO2e) in other greenhouse gases. In the first article of our carbon markets series, we provided an overview of carbon offsets and carbon credits. We also clarified the distinction between voluntary and compliance carbon markets and briefly explored the process of generating a carbon credit. However, before setting out to generate or trade credits, it is crucial to grasp the intricacies of the system and understand the diverse stakeholders who collaborate to facilitate market operations.

Over the past two decades, the voluntary carbon market has evolved by establishing processes that enable smooth exchange of carbon credits. Several non-governmental entities and registries (such as Gold Standard and Verra) work to enable the self-regulation of the market.

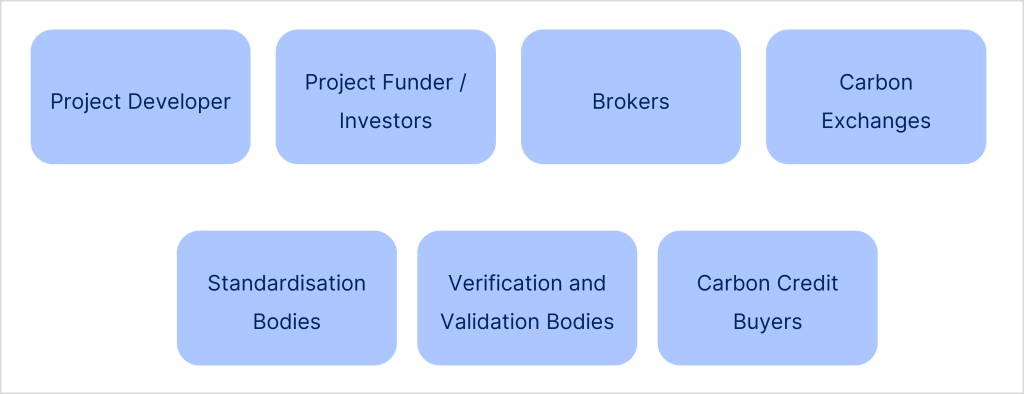

Stakeholders in the Voluntary Carbon Market

Creating, executing, and managing voluntary carbon offset projects necessitates the participation of stakeholders and authorities. While the specific individuals involved may vary from project to project, certain market participants remain consistent. Each of the identified stakeholders contributes to different aspects such as project development, certification, verification, financing, and market facilitation.

Project Developers

Project developers refer to organisations leading projects that sequester (capture) carbon or avoid carbon from being released into the atmosphere. Project developers are the first in a chain of actors that have paved the way for VCM. They implement projects to preserve ecosystems, protect biodiversity and pioneer new green technologies, while often ensuring that revenues go back to local communities who are in the direst need for the same. Project developers can include a broad range of actors with differing levels of capacity implementing from very small to large projects. In the following section, we have listed entities that may be project developers.

1. Private companies: Private companies such as Microsoft, Infosys, and Shell specialise in developing carbon credit projects and these companies often have expertise in specific sectors such as renewable energy, forestry or waste management.

2. Non-governmental organisations: Environmental NGOs work on a wide range of initiatives such as forest conservation, reforestation, sustainable land management and renewable energy deployment. They try to simultaneously pursue environmental and social integrity. While several of these NGOs partner with international trusts for finance, local communities are often onboarded in the implementation process.

3. Financial Institutions: Development Banks and national development agencies can finance projects that generate carbon credits. Apart from lending activities, these institutions also provide technical expertise and capacity-building support to help implement economically and ecologically efficient projects.

4. Governments and public agencies: They can initiate and implement projects in areas such as renewable energy deployment, energy efficiency programs, afforestation and sustainable agriculture. Governments can support project development through policy frameworks, grants and other incentives to stimulate emission reduction activities.

5. Community-based organisations: local communities and indigenous groups are increasingly getting involved in projects that can develop carbon credits. These projects revolve around sustainable land management, reforestation and other initiatives that deliver social and economic benefits to the local population alongside environmental benefits. These projects provide an opportunity for local communities to leverage their traditional knowledge and land resources.

Project Funder / Investors

Projects can either be self-funded by the developer, or institutions such as banks, equity firms, private investors, non-profit organisations and development finance institutions. Investors play a crucial role in seed funding and scaling up projects in the VCMs. The VCM is at its inflection point and is estimated to have channelled USD 1.2 billion in investment flows in 2022.

Brokers

Brokers act as intermediaries between buyers and sellers, connecting parties interested in buying or selling carbon credits. The primary function of brokers is to match buyers and sellers based on their respective preferences and requirements. They leverage their market expertise and networks to identify suitable opportunities and negotiate transactions on behalf of their clients. Brokers help buyers find carbon credits that align with their sustainability goals, while also assisting sellers in effectively monetising their carbon offsets.

Brokers often stay up-to-date with the latest market trends, pricing dynamics, and regulatory developments, enabling them to provide informed recommendations. They help buyers navigate the diverse range of available carbon offset projects, assess the credibility and quality of credits, and make well-informed purchasing decisions.

Additionally, brokers assist sellers in showcasing the unique attributes and benefits of their carbon credits. They help sellers package and market their offsets effectively, increasing their visibility and attractiveness to potential buyers. Brokers may also provide support in structuring and negotiating contracts, ensuring that the terms and conditions of the transaction are favourable for their clients.

Carbon Exchanges

Carbon exchanges such as ACX and CBL serve as platform where buyers and sellers can come together to buy and sell carbon offsets. The primary function of carbon exchanges is to facilitate the matching of supply and demand for carbon credits. They provide a transparent and regulated environment where market participants can engage in transactions with confidence. By offering a centralised trading platform, carbon exchanges enhance liquidity in the market and enable efficient price discovery.

Carbon exchanges establish the necessary infrastructure and systems to support trading activities. They create standardised contracts and trading protocols that streamline the process of buying and selling carbon credits. These standardised contracts often include specific terms and conditions related to the quality, eligibility, and verification of carbon credits, ensuring consistency and compliance with industry standards.

Furthermore, carbon exchanges play a critical role in ensuring the integrity and credibility of the voluntary carbon market. They enforce robust verification and validation procedures to ensure that the carbon credits listed for trading meet stringent quality criteria. By maintaining rigorous listing requirements and conducting due diligence on project developers and their credits, exchanges help mitigate the risk of fraudulent or low-quality offsets.

Carbon exchanges also provide transparency by publicly disclosing information related to traded volumes, prices, and market trends. This information allows market participants to make informed decisions and helps establish market benchmarks for carbon credit pricing.

Standardisation Bodies

In the absence of a common standard governing the market, the carbon trading arena risks becoming a fragmented and complex market space saturated with standards. Standardisation bodies can help accelerate the journey towards a low-carbon economy by installing trust and transparency in the carbon markets. One such body – Gold Standard has alone supported the reduction/removal of 238 million tonnes of CO2 and created 36 billion dollars of shared value from verified sustainable development impact.

Standardisation bodies play a crucial role in the voluntary carbon market. Their primary function is to develop and establish methodologies, guidelines, and criteria that ensure consistency and credibility in the measurement, verification, additionality assessment, and accounting of carbon offset projects. These bodies work towards setting clear and transparent standards for project developers, verifiers, and buyers, which helps build trust and confidence in the market. They define rigorous methodologies for calculating emissions reductions or removals, ensuring accuracy and reliability in determining the carbon credits generated by a project.

These bodies also establish best practices for project documentation, monitoring, and reporting. They may outline specific requirements for project registration, tracking of emission reductions, and independent third-party verification. By adhering to these standards, project developers can demonstrate their compliance with recognized guidelines and increase the marketability of their carbon credits. Moreover, these bodies contribute to the development of a common language and framework within the voluntary carbon market. They facilitate communication and understanding among various stakeholders by providing clear definitions, terminology, and processes.

Verification and Validation Bodies (VVBs) /Designated Operational Entities (DOEs)/ Third party auditors

Third party auditors act as independent evaluators responsible for assessing, validating and verifying the legitimacy and accuracy of carbon offset projects. These auditors are appointed by market participants to conduct thorough assessments of the projects, ensuring they adhere to established standards and guidelines. Their objective is to provide an unbiased evaluation of the project’s emission reduction or removal claims.

They assess the project’s documentation, methodologies, and monitoring systems to verify the reported emissions reductions or removals. During the auditing process, these independent professionals may conduct site visits, interviews, and data inspections to validate the project’s implementation and compliance with the required protocols.

The role of third-party auditors is essential in building trust and confidence in the voluntary carbon market. Their unbiased assessments provide assurance to buyers and other market participants that the carbon credits they are purchasing have undergone rigorous verification. This verification process helps to prevent greenwashing and ensures the integrity of the market.

The large carbon registries in the VCM such as Verra and The Gold Standard generally publish a list of criteria that must be satisfied for an organisation to request carbon credits/offsets. The more robust organisations demand verification across several stages of the project:

1. Certification that new protocols adhere to relevant standards and are complete, relevant, consistent, accurate, and transparent.

2. Certification that emission reduction project proposals adhere to relevant protocols and will result in valid credits if executed as described. This includes ensuring that leakage and additionality requirements are satisfied.

3. Certification that before credits are issued, the emission reductions have actually taken place, including verification of any physical measurements needed.

Carbon Credit Buyers

In the voluntary carbon market, carbon credit buyers are entities or individuals that purchase carbon credits voluntarily to offset their own greenhouse gas emissions or to support sustainability and environmental goals. These buyers can include companies, organisations, governments, institutions, and even individuals. By purchasing carbon credits, buyers demonstrate their commitment to reducing their carbon footprint and mitigating climate change. Their actions contribute to the overall goal of achieving a more sustainable and low-carbon future.

Complexities addressed by the stakeholders

The voluntary carbon market requires the involvement of multiple stakeholders due to the complex and interconnected nature of addressing climate change and achieving emissions reductions. Here are some reasons why the voluntary carbon market necessitates the participation of various stakeholders:

1. Diverse Expertise: Tackling climate change and implementing effective carbon offset projects require expertise from different fields such as science, policy, finance, project development, and verification. Each stakeholder brings unique knowledge and skills to the table, contributing to the overall success of the market.

2. Market Functioning: The voluntary carbon market operates as a marketplace where buyers and sellers interact. The presence of multiple stakeholders ensures the smooth functioning of the market by providing necessary services such as project development, verification, auditing, trading platforms, and financial instruments. These stakeholders perform specific roles and functions that collectively support the operation and growth of the market.

3. Credibility and Integrity: The involvement of various stakeholders helps establish credibility and maintain the integrity of the voluntary carbon market. Independent third-party verifiers, auditors, and standardisation bodies ensure that carbon offset projects meet stringent standards and undergo rigorous assessments. Their oversight and expertise enhance trust among market participants and protect against the risk of fraudulent or low-quality carbon credits.

4. Transparency and Accountability: Stakeholders in the voluntary carbon market contribute to transparency and accountability. Brokers, exchanges, and registries facilitate transparent transactions, record-keeping, and tracking of carbon credits. Project developers and sellers are accountable for accurate reporting, monitoring, and verification of emissions reductions. Buyers play a role in demanding transparency and credible carbon credits, driving market standards and best practices.

5. Collaboration and Impact: Climate change is a global challenge that requires collaboration among multiple stakeholders to achieve meaningful impact. Engaging stakeholders from different sectors, including businesses, governments, NGOs, and communities, allows for collective efforts and knowledge-sharing. Collaboration helps drive innovation, create partnerships, and scale up the implementation of carbon offset projects to address the urgency of climate action.

6. Market Development and Growth: The voluntary carbon market is continually evolving and expanding. The participation of various stakeholders, such as project developers, investors, brokers, and buyers, stimulates market growth, fosters competition, and encourages innovation. Their collective engagement helps develop new methodologies, improve practices, and explore emerging opportunities in the market.

By working together, these stakeholders contribute to the collective goal of mitigating climate change and creating a more sustainable future.