The Indian Commercial and Industrial (C&I) sector stands at a crucial juncture in its energy transition journey. With electricity costs constituting a significant portion of operational expenses and corporate sustainability commitments gaining prominence, businesses are increasingly turning to renewable energy solutions. However, the first and most critical decision in this journey is choosing between capital expenditure (capex) and operational expenditure (opex) models for renewable energy procurement.

Understanding the Models in the Indian Context

The renewable energy landscape in India offers two primary procurement models, each with its distinct characteristics and implications for businesses. Let’s delve into what each model entails before comparing their various aspects.

The Capex Model explained

In the capital expenditure model, the business takes complete ownership of the renewable energy asset. This typically involves installing solar panels on your facility’s rooftop or available ground space. The entire system becomes your company’s asset, giving you complete control over its operation and the energy it produces. Think of it as buying a house instead of renting – while the initial investment is substantial, you own the asset and all its benefits.

The Opex Model decoded

The operational expenditure model, also known as the RESCO (Renewable Energy Service Company) model in India, functions more like a partnership. A third-party developer takes responsibility for the system while your business simply purchases the power produced. This arrangement is formalised through a Power Purchase Agreement (PPA), similar to your current arrangement with the grid, but typically at lower rates and with green energy benefits.

Comparing the models

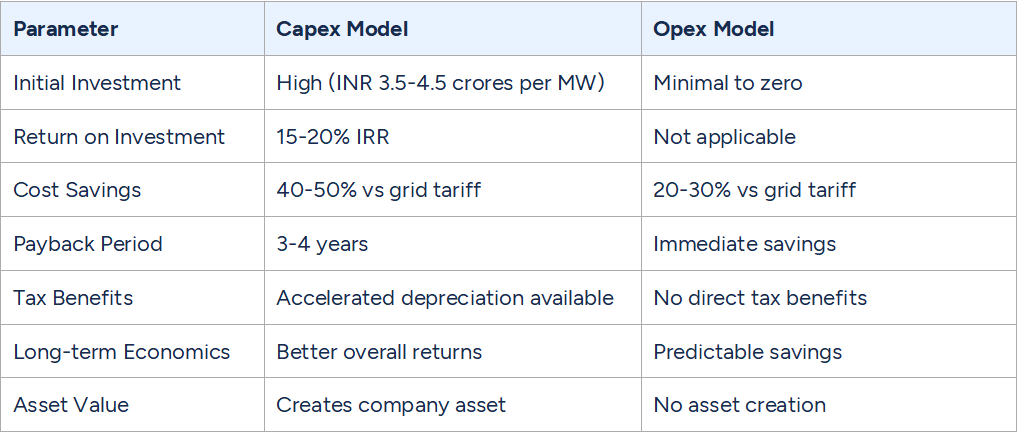

Let’s break down the key differences between these models across various parameters:

Financial considerations

Operational considerations

Risk considerations

Making an Informed Decision

The choice between capex and opex models should be based on a thorough evaluation of your business’s specific circumstances. Here’s a detailed analysis of when each model makes the most sense:

The case for capex

The capital expenditure model particularly shines for businesses with strong financial fundamentals and a long-term perspective. Consider this model if your business has:

- A strong balance sheet with available capital or access to favourable financing options. This is particularly relevant for large manufacturing units or established industrial players who can efficiently utilise the accelerated depreciation benefits and other tax incentives available in India.

- Technical capabilities either in-house or through strong vendor relationships. Many large industrial houses in India have dedicated engineering teams that can effectively manage renewable energy assets.

- Long-term operational stability and ownership/long-term lease of the premises. For instance, automotive manufacturing plants or large process industries with stable operations can benefit significantly from the higher returns of the capex model.

The case for opex

The operational expenditure model proves advantageous for businesses focused on operational excellence and capital conservation. This model is particularly suitable when:

- Your business wants to conserve capital for core operations or has other investment priorities. This is often the case with expanding businesses or those in capital-intensive growth phases.

- The focus needs to remain on core business operations without diverting management bandwidth to power generation. Many commercial establishments and data centres prefer this model to maintain their operational focus.

- There’s uncertainty about long-term facility usage or a need for flexibility in energy procurement. This is particularly relevant for leased facilities or businesses with evolving energy needs.

Industry-specific Insights

Different sectors within the C&I space have unique considerations that influence their choice between capex and opex models.

- Manufacturing facilities, with their high power consumption and stable operations, often find the capex model more suitable. The significant cost savings and ability to utilise tax benefits make the initial investment worthwhile. However, the decision might vary based on the facility’s size and operational maturity.

- Commercial real estate presents a more complex scenario. Multiple stakeholders, varying load profiles, and tenant satisfaction considerations often make the opex model more attractive. The predictability of costs and professional maintenance can be significant advantages in this sector.

- Data centres, with their critical power quality requirements and high-capacity utilisation, might find value in either model depending on their scale and operational strategy. Many choose a hybrid approach, combining elements of both models to optimise their energy procurement.

Success stories with the capex model

1. Tata Motors – Pune Manufacturing Facility

Tata Motors’ implementation of a 21 MW rooftop solar project at their Pune plant stands as one of India’s largest captive solar installations in the automotive sector. Project details were:

- Investment: Approximately ₹95 crores

- Annual Generation: 32 million units

- Cost Savings: ₹17 crores annually

- Payback Period: Achieved in under 4 years

- CO2 Reduction: 21,000 tons annually

The company leveraged its strong balance sheet and technical expertise to execute this project in-house. The success factors included:

- Effective utilisation of accelerated depreciation benefits

- Integration with existing facility management systems

- Comprehensive vendor assessment and quality control

- The in-house engineering team for maintenance

2. ACC Limited – Cement Manufacturing Units

ACC Limited implemented a distributed captive solar solution across multiple cement plants, totalling 40 MW. Project details were:

- Investment: ₹180 crores

- Annual Generation: 45 million units

- Cost Savings: Over ₹24 crores annually

- Technical Innovation: Smart integration with cement plant load management

- Achievement: 15% reduction in grid dependency

The project’s success was driven by:

- Strategic use of unutilised land within plant premises

- Integration with existing power systems

- Robust maintenance protocols

- Effective utilisation of tax benefits

3. Infosys – Pan-India Solar Implementation

Infosys’s comprehensive renewable energy strategy across its campuses showcases large-scale capex implementation. Project details were:

- Total Capacity: 60 MW across various locations

- Investment: ₹250 crores

- Annual Generation: 80 million units

- Cost Savings: ₹35 crores annually

- Achievement: First Indian IT company to become carbon-neutral

Key success factors:

- Standardised design across locations

- In-house centre of excellence for renewable energy

- Integrated building management systems

- Strong focus on performance monitoring

Success stories with the opex model

1. Delhi Metro Rail Corporation (DMRC)

DMRC’s partnership with SECI for solar power procurement demonstrates the successful implementation of the opex model. Project details were:

- Capacity: 99 MW through RESCO model

- PPA Rate: ₹3.64/unit

- Annual Savings: ₹9 crores

- Contract Period: 25 years

- Unique Feature: Mixed portfolio of ground-mounted and rooftop installations

Success factors included:

- Zero upfront investment

- Professional O&M by developer

- Guaranteed performance ratios

- Flexible power consumption patterns

2. Hindustan Unilever Limited – Pan-India Implementation

HUL’s strategic partnership with Amp Energy for renewable energy procurement across multiple facilities. Project details were:

- Total Capacity: 50 MW across various locations

- PPA Duration: 15 years

- Cost Saving: 30% reduction in power costs

- Environmental Impact: 80,000 tons CO2 reduction annually

- Implementation: Mix of on-site and off-site installations

Key advantages realised:

- Standardised PPA terms across locations

- Professional asset management

- No operational responsibilities

- Predictable energy costs

3. BigBasket – Warehouse Operations

BigBasket’s implementation of solar solutions across their warehouse network through the RESCO model. Project details were:

- Capacity: 5 MW distributed across multiple warehouses

- PPA Rate: Significant discount to grid tariff

- Contract Period: 20 years

- Special Feature: Scalable implementation as warehouses expand

- Impact: 15-20% reduction in operational costs

Success factors:

- Flexibility in scaling with business growth

- No impact on warehouse operations during installation

- Professional maintenance ensures continuous operations

- Predictable power costs for cold storage facilities

These case studies demonstrate how different businesses have successfully leveraged both capex and opex models based on their specific requirements, financial capabilities, and operational priorities. The choice of model was influenced by factors such as:

- Available capital and investment priorities

- Technical expertise and operational focus

- Long-term facility planning

- Risk appetite and management preferences

- The regulatory environment in specific states

Recent Market Trends and Innovations

The renewable energy market in India continues to evolve, introducing innovative solutions that blur the traditional lines between capex and opex models. Group captive models have gained popularity, especially among medium-sized enterprises, offering ownership benefits with lower capital requirements. The recent Green Energy Open Access regulations have also opened new avenues for businesses to procure renewable energy, regardless of their chosen model.

Implementation Roadmap

Whichever model you choose, successful implementation requires careful planning and execution. For capex projects, focus on detailed technical feasibility, vendor selection, and long-term maintenance planning. In opex arrangements, emphasis should be on developer evaluation, PPA negotiation, and performance monitoring systems.

Conclusion

The choice between capex and opex models for renewable energy procurement is a significant decision that impacts your business’s financial and operational dynamics. While capex offers better long-term returns and complete control, opex provides flexibility and minimal operational responsibility. The right choice depends on your business’s specific circumstances, including financial capabilities, technical expertise, and long-term strategic objectives.

Neufin can help you navigate your business’s renewable energy procurement journey by breaking down the complexities of regulations, incentives, and technical requirements to make an informed decision that aligns with your overall goals. As a first step, learn how much can your business save on electricity costs by trying out the Neufin Energy Analyser.