It’s not often that an opportunity comes along that has the potential to engage you for a generation. A desire to do something meaningful with our lives is quite common to many but translating that desire into action is hard work (with maybe a bit of luck thrown in).

The Neufin story started when my co-founder Rushil and I decided we’d had enough of selling diapers and digitising bank accounts for millennials (I make light of it, the jobs were great, but the reader might understand if they were in a similar position). We gravitated to climate change – having seen first-hand the painful effects of the lack of habitat restoration in the places we grew up in (across nearly 15 cities and towns in India). However, trying to translate passion into a business is hard. We went chasing a huge, impactful problem to solve. After all, why would we want to do anything less? Our respective B-schools trained us to approach this goal systematically. Months were spent locked in Rushil’s Mumbai flat figuring out the right problem, customer segment, and business model – and we arrived at an early version of what Neufin is trying to build today.

Our ‘aha’ moment

Our journey after close to 160 conversations with businesses, financiers, government agencies, and many others along the way acquainted us with three hard truths:

1. The pace of climate action needed to step up big time (this was largely known but the scale of the shortfall was alarming, ~23gigatons gap in planned vs actuals to keep global warming within 1.50 C)

2. Collective action was required for any change to be affected – by both private enterprises and governments.

3. Businesses were struggling to execute their climate transformation plans, specifically on three fronts:

a. Capital

b. Expertise

c. New Technology

The financing gap (3a) came up in most conversations and for good reason, globally there is a $10 trillion/year gap in climate finance. Further, the markets are unstructured, there are many new and existing financing institutions, and every business will be required to draw up a plan to be climate resilient over the next decade. We see this as THE most critical gap to address to accelerate the decarbonisation trajectory that we are on. Companies that find the transition to greener practices (be it through ESG measurements, cost savings, positioning, etc.) will likely create a virtuous cycle – doing more themselves and encouraging other businesses to follow suit.

Businesses require support on this hard journey that they are on. There is relatively very little knowledge sharing between companies in the same sector and oftentimes the same pincode. Solving this problem requires solving several challenges – information, the right mix of financial products, distribution, and a fundamental understanding of climate risk. Numerous stakeholders need to come together to make the financing ecosystem work at scale.

While we can’t solve everything, we believe that addressing the most pressing problem i.e. improving access to Green Financing would have the maximum impact. Getting businesses to access to the right capital is critical to have any chance of improving the current pace of climate action.

Neufin Mission

To be the platform that powers the world’s transition to zero emissions.

In a market that’s opaque and difficult to access with multiple stakeholders involved, we believe a platform approach is the most efficient. Through innovative delivery of financial products, we aim to bridge this $10 trillion / year gap across key stressed geographies – India, Africa, SEA, and MENA.

Unlike most problems, the climate crisis is truly time-sensitive. Not meeting targets implies a rise in temperatures, an increase in sea levels, flooding, and many other imaginable tragedies. If successful, we hope to have a direct impact on the pace at which our planet can decarbonise. This is the real impact we want to make.

Our Report Card

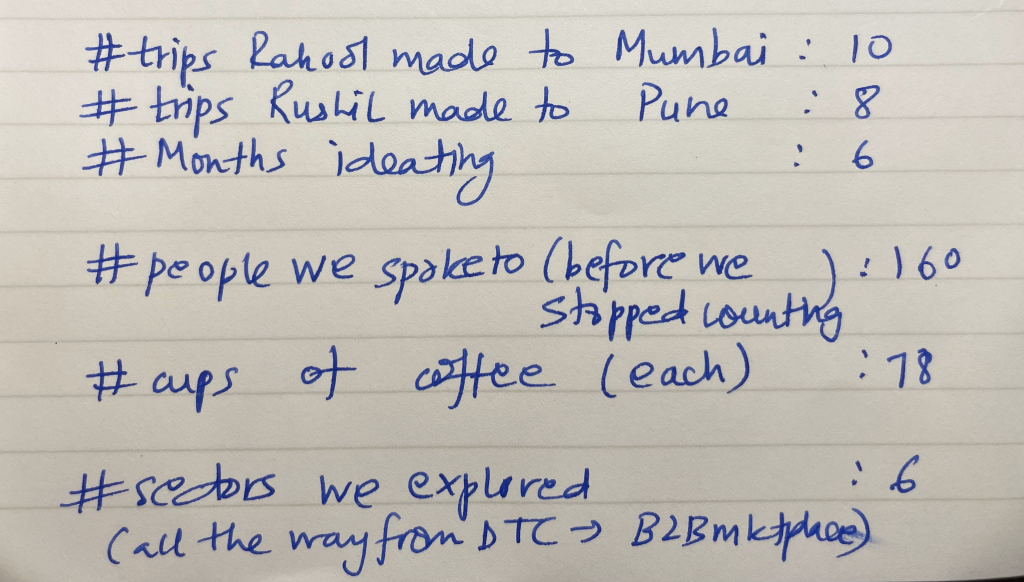

On a lighter note, we thought we’d share with you the scorecard we maintained while going through our ideation process. When doing it we reckoned that one day (far far away) perhaps we’d look at it and have a good laugh. I suppose that day is here, shared for the reader’s reference below (we do not recommend drinking as much coffee as we did though):

In subsequent posts, we’ll cover more details and numbers on the scope of the climate financing problem, what is being done today, and how Neufin is addressing the gap(s) in the market.