For years, global companies with ambitious climate goals have turned to Virtual Power Purchase Agreements (VPPAs) as a way to secure renewable energy (RE), stabilise long-term electricity costs, and support the creation of new clean energy projects. These financial contracts have powered the decarbonisation journeys of large buyers across the US, Europe, and Australia.

But in India, despite growing interest from corporate buyers and developers alike, VPPAs have remained out of reach. A lack of regulatory clarity, coupled with jurisdictional ambiguity, kept the mechanism in limbo.

That might be changing. On 22 May 2025, the Central Electricity Regulatory Commission (CERC) released draft guidelines for VPPAs. This is the first formal step towards creating a functioning market for financial PPAs in India, with implications for corporates, developers, and market intermediaries alike.

What Is a VPPA?

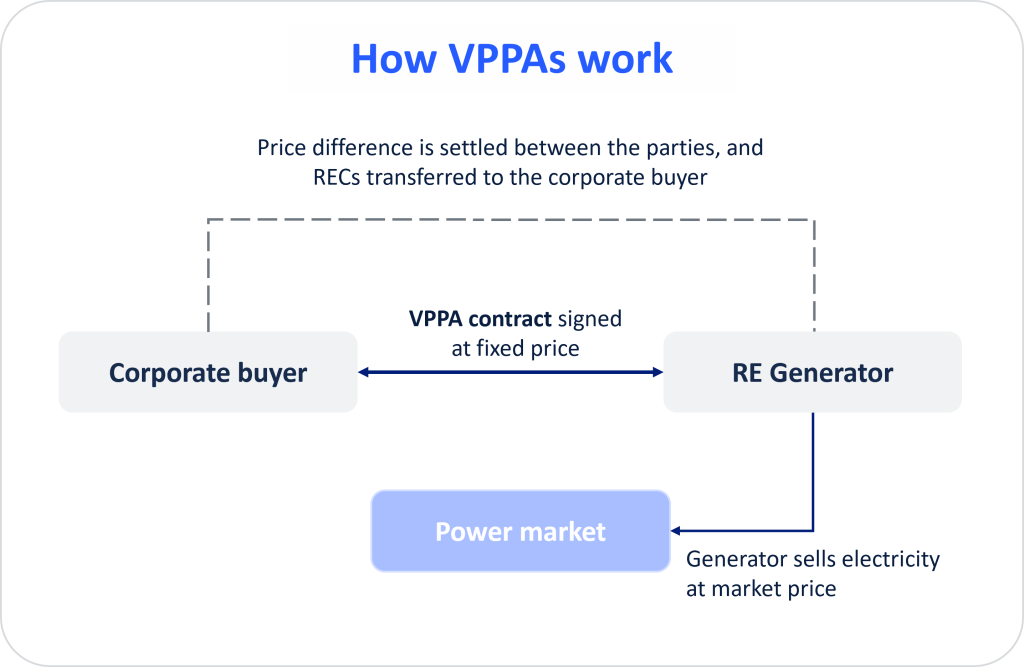

A Virtual Power Purchase Agreement is a long-term financial contract between a RE generator and a buyer, typically a large corporate. Unlike a physical PPA, the electricity generated does not flow directly to the buyer’s facility. Instead, the generator sells the power into the electricity market at the prevailing rate. The buyer and generator settle the difference between the market price and a fixed contract price that they have agreed upon.

This is known as a “contract for difference” model. If the market price exceeds the contract price, the generator pays the difference to the buyer. If the market price falls below the contract price, the buyer pays the generator. In return, the buyer receives the environmental attributes in the form of Renewable Energy Certificates (RECs), which can be used to meet sustainability or compliance targets.

In practice, VPPAs help corporates hedge against electricity price fluctuations, support the addition of new renewable capacity to the grid, and make credible claims about the renewable origin of their electricity.

Where VPPAs Already Work

VPPAs have seen widespread adoption in the United States, where regulatory frameworks and nodal market operators like PJM and ERCOT have enabled large-scale corporate procurement. Tech firms, manufacturers, and retailers have signed multi-year deals, creating new wind and solar capacity while managing their long-term energy exposure.

In Europe, similar mechanisms exist, though cross-border complexity and differences in national energy systems require more nuanced structuring. Australia, too, has seen corporates use VPPAs to contract solar and wind power, often as part of their broader emissions reduction plans.

In all these regions, VPPAs are not just financial tools, they are central to corporate climate action, allowing buyers to contract RE electricity from distant projects that may never physically power their facilities.

Why VPPAs Stalled in India

Despite India’s growing RE capacity and maturing power exchanges, VPPAs have not taken off here. The primary reason has been regulatory ambiguity. For years, the question of who regulates financial power contracts, CERC or SEBI, remained unresolved. VPPAs, by their nature, are contracts that involve financial settlement without physical delivery. This led to confusion about whether they should be treated as electricity contracts or financial derivatives.

Additionally, there was no framework to link the environmental attributes of power purchased through VPPAs with India’s Renewable Energy Certificate (REC) system. Without this link, companies could not demonstrate compliance or progress towards voluntary targets such as RE100 or Science Based Targets.

Meanwhile, the open access regime remained the dominant mode for RE procurement by corporates, but it is often constrained by grid limitations, regulatory delays, and facility-level feasibility. For companies operating leased buildings, campuses in disaggregated locations, or smaller loads, physical procurement is not always viable. VPPAs are an obvious solution for such cases, but until now, India lacked a legal foundation to make them work.

What the CERC Draft Guidelines Say

The CERC’s draft guidelines are an attempt to close these gaps and establish a legitimate structure for VPPAs. Here’s what they propose:

1. Regulatory Oversight

The guidelines make it clear that VPPAs are under CERC’s jurisdiction. They are defined as over-the-counter (OTC), non-tradable, and non-transferable bilateral contracts executed between a renewable energy generator and a consumer.

This clarity addresses the regulatory tussle with SEBI and removes one of the biggest barriers to adoption.

2. Eligible Buyers and Use-Cases

The guidelines state that VPPAs can be used by “designated consumers”, which includes large industrial units, DISCOMs, and open access customers, to meet their Renewable Consumption Obligation (RCO). However, general consumers are also identified as eligible, opening the door for voluntary procurement to meet ESG goals or internal decarbonisation targets.

This dual-purpose framing allows both compliance and voluntary buyers to participate in the market.

3. REC Eligibility and Treatment

Renewable energy generated under a VPPA is eligible for the issuance of RECs under the REC Regulations, 2022. However, these RECs are:

- Non-tradable

- Non-transferable

This means VPPAs can help meet RCOs or internal climate goals, but cannot be used to create speculative value or tradeable credits. It also implies that I-RECs and other international instruments remain outside the scope of this framework for now.

4. Contract Execution and Platform Options

VPPAs can be executed directly or via a CERC-registered trader or OTC platform. This flexibility ensures multiple pathways for contracting, depending on the scale and sophistication of the buyer.

5. Financial Settlement

The guidelines formalise the “contract-for-difference” model. Bilateral financial settlement will occur between the buyer and seller based on the difference between the strike price and the realised market price.

This provides the backbone of the VPPA structure and allows buyers to lock in predictable RE attributes, regardless of grid volatility.

6. Project Registration Requirement

Projects participating in a VPPA must be registered under the REC framework. This ensures traceability and linkage between generation, certificates, and claims.

Outstanding Issues

While the guidelines represent progress, several questions remain:

- Waivers and Concessions: Under current REC rules, projects that receive concessional wheeling or transmission charges are not eligible for RECs. This restriction, if applied to VPPA-linked projects, could limit their financial viability.

- Dispute Resolution: The guidelines refer to bilateral contracts but do not spell out the extent of CERC’s role in adjudication. In the absence of defined arbitration mechanisms, this could become a point of concern for buyers and sellers.

- Nodal Agencies: The role of state nodal agencies in verifying compliance or facilitating transactions is not defined. Their involvement could be critical, especially for designated consumers meeting RCOs.

- Accounting Clarity: The financial settlement structure, often resembling a “fixed-for-floating” swap, involves complex accounting. Guidance is needed on how buyers should record these contracts, particularly for ESG and financial reporting.

- Non-Transferability vs Flexibility: The restriction on transferring RECs may make sense from a regulatory risk perspective, but limits flexibility. Globally, carbon credit standards like Verra and Gold Standard have found ways to prevent double counting without banning transfers outright.

Why It Matters Now

India’s clean energy targets require rapid growth in demand-side participation. While the Green Open Access Rules of 2022 helped reduce the minimum load threshold to 100 kW, they still do not solve the problem for companies with fragmented or leased operations. VPPAs fill that gap.

According to the WWF–ICF study, India’s VPPA market could reach:

- 22 GW in a conservative scenario

- 69 GW in a realistic scenario

- 104 GW in an optimistic scenario

What This Means for Corporate Buyers

Companies in India are increasingly setting science-based targets, joining RE100, or preparing for export-facing climate compliance. But not all companies can access open access or rooftop solar. VPPAs offer a viable alternative, particularly for mid-sized or multi-site businesses.

At Neufin, we are actively working with businesses to explore these newer mechanisms. Whether it’s assessing the commercial viability of a VPPA, building procurement models that combine physical and financial instruments, or mapping out compliance pathways for RCO and RE100 targets, our aim is to help companies make informed, future-ready energy decisions.

If you’re a business exploring new ways to meet your RE goals, especially in hard-to-decarbonise settings, this moment could be the inflection point. The policy groundwork is finally being laid. Now is the time to act.