Plastics are, inarguably, an indispensable part of our lives. Their use permeates every industry – from syringes and doctors’ gloves to automobile components and credit cards – they’re everywhere. While we can certainly make efforts to avoid using plastics in our everyday lives, eliminating dependency is a distant reality on multiple accounts. It is cheap, accessible, and versatile for it can be moulded, shaped, and modified to meet a variety of functional requirements. Then again, its use comes at an environmental cost that cannot be overstated – the material is nonbiodegradable, and fossil fuel driven – making it a villain in the battle against climate change.

The plastic problem is particularly pervasive in India, the fifth larger producer of the material in the world. In 2019 alone the country generated 3.4 million tonnes (MT) of plastic waste, only 30% of which was (debatably) recycled. Taking cognizance of the increasing demand for plastic and the mounting waste problem, the government is taking action. In recent years it has taken several audacious steps including banning the use of single-use plastics and introducing the Extended Producer Responsibility (EPR) framework, forcing the private sector to ensure a switch to using recyclable materials and ensuring longer life cycles of the plastics used.

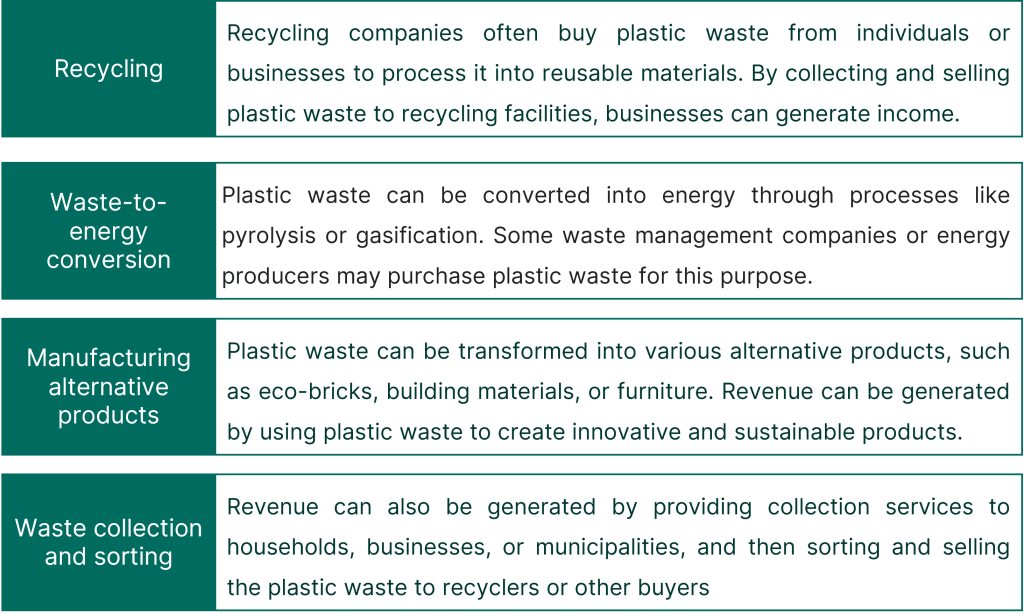

These steps, however important they may be, come with a degree of financial and administrative burden for the private sector. To comply with binding regulatory frameworks and bridge this financing gap entities often turn to the many ways of monetising the plastic waste they generate.

What are plastic credits?

Plastic credits, also known as plastic offsets, are a market-based mechanism to incentivise and finance the reduction and removal of plastic waste from the environment. The concept is similar to carbon credits, which are used to incentivize and finance the reduction of greenhouse gas emissions. They work by allowing organisations to offset their plastic waste footprint by purchasing credits from projects that remove or reduce plastic waste in the environment. Plastic credit projects can take various forms, including waste collection and recycling programs, beach clean-ups, and initiatives to reduce plastic use and promote sustainable practices. Organisations can then purchase these credits to offset their own plastic waste footprint, similar to carbon offsetting.

Types of plastic credits:

1. Waste collection credit: One waste collection credit represents the environmental service of recovering 1 tonne of plastic from the environment and directing it to an appropriate final destination. Two kinds of projects qualify for waste collection credits:

a) Environmental clean-up using riverine and water technologies e.g. waste collection device, trash booms, litter traps, etc. or through community led clean-ups etc.

b) Improved Waste Management through household waste collection programs, formalised waste picker programs, and deposit return schemes etc.

2. Plastic recycling credit: One plastic recycling credit represents the environmental service of recycling 1 tonne of plastic that would not otherwise be recycled. Examples of projects that qualify for plastic recycling credits are:

a) Small scale mechanical recycling

b) New industrial mechanical recycling facility

c) Expansion of an existing mechanical recycling facility

d) Chemical recycling facility – methodology in development

Eligibility

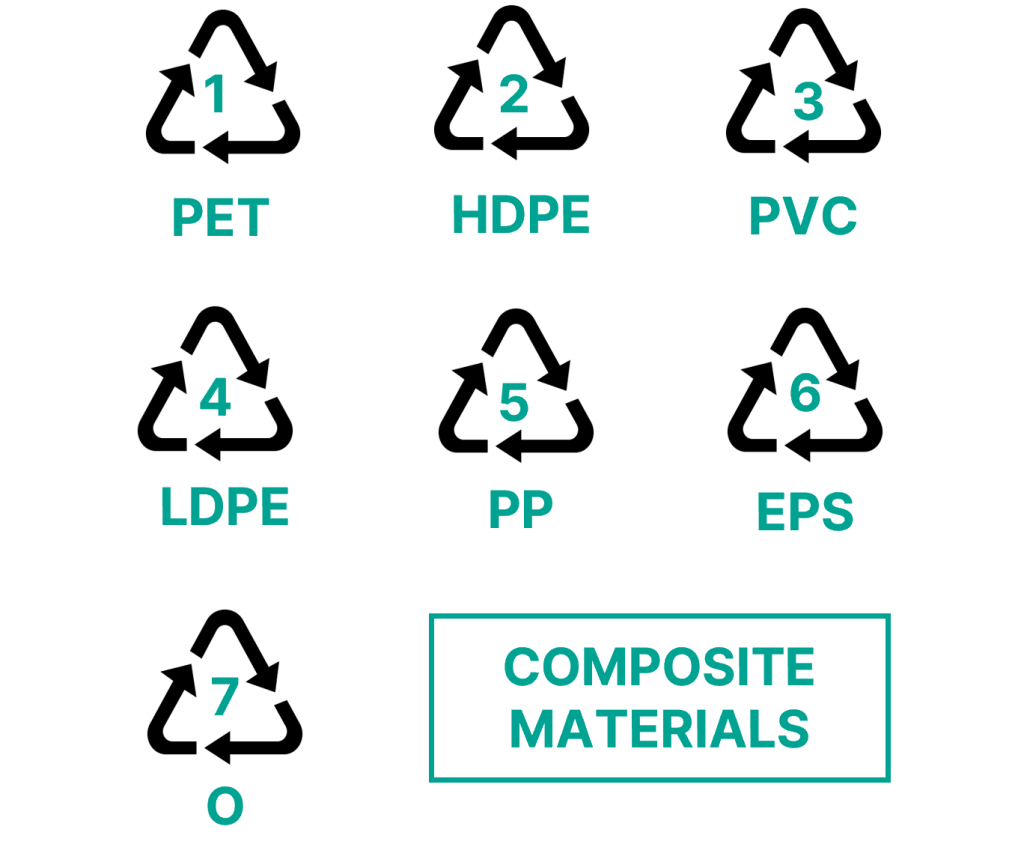

For a project activity to be considered for a plastic credit it must fulfil the additionality clause, which means, it must be proven that the activity leads to the collection or recycling of plastic waste beyond what would have likely happened without the project. Furthermore, the activity would not have taken place if it weren’t for the incentive provided by the plastic crediting mechanism. The concept of additionality is crucial when it comes to these credits because it signifies that they bring about a genuine environmental advantage by reducing plastic waste in the environment compared to what would have happened without the project. Additionally, the standardising body, Verra, only considers projects that were initiated on or after 1 January 2016 as eligible for its plastic credits program. The table below lists the different types of plastic that fall under the scope of this program.

Pricing of Plastic Credits

The value of plastic credits is determined by various factors related to the project from which they originate. Depending on various factors, the price of one plastic credit may range 200 – 800 EUR. These factors include the nature of the project itself, such as whether it focuses on plastic collection or recycling, its geographical location, the type of material being processed, and the social impact it creates. Each credit represents one metric ton of plastic waste that has been collected or recycled. However, these credits can also be enhanced by adding supplementary certifications. For instance, a project may obtain certifications highlighting its positive social and environmental contributions, such as the creation of better wages for workers or a significant reduction in marine pollution.

In many markets, obtaining additional certifications tends to enhance the value of plastic credits. These certifications provide a means to recognize and reward projects that go beyond basic waste management and actively contribute to wider social and environmental goals. By obtaining such certifications, projects can potentially increase the worth of their credits, making them more attractive and valuable to investors and stakeholders.

Near and long-term potential

Though such credits cannot not be a substitute for reducing plastic use and waste, and companies must prioritise waste reduction and recycling efforts over offsetting, they do offer a valuable opportunity to kickstart EPR programs by presenting successful waste reduction projects and a strong framework for evaluating different EPR initiatives. As part of this, regulators can permit companies obligated to meet EPR requirements to utilise plastic credits instead of paying EPR fees. This system facilitates a streamlined transfer of resources from these companies directly to projects focused on collecting and recycling plastic waste, ultimately reducing the administrative burden on the government.

In the near term, this approach can help corporate leaders reduce potential negative externalities associated with the plastic waste generated and catalyse investment in new waste recycling and collection efforts. Plastic credits also have the potential to support implementation of waste reduction commitments and obligations in the longer term by helping mitigate some uncontrollable plastic leakage from a company’s value chain.